- Minimum Deposit Framework at Exness

- Deposit Rates and Conditions at Exness

- Starting Your Business Journey with Exness

- Deposit Methods and Fees at Exness

- Currency Options for Exness Accounts

- How to Deposit Money into Exness: A Step-by-Step Guide

- Security of your Funds Deposited in Exness

- Frequently Asked Questions about Minimum Deposits at Exness

Minimum Deposit Framework at Exness

Exness tailors its minimum deposit requirements depending on the account type and geographic location of the trader, offering flexibility for both newbies and market veterans:

- Standard Accounts: Ideal for beginners, these accounts may require a minimum deposit as low as $1, depending on the region, allowing an accessible entry point for new traders.

- Professional Accounts: Aimed at experienced traders, accounts like Raw Spread, Zero and Pro generally require a minimum deposit of $200. These accounts offer advanced trading conditions with tighter spreads, suitable for sophisticated trading strategies.

Deposit Rates and Conditions at Exness

Exness distinguishes itself by offering competitive and efficient deposit conditions, designed to maximize traders’ investments:

- Currency Conversion: Although Exness does not impose deposit fees, it is crucial to consider possible currency conversion costs if deposits are made in a currency other than the base currency of the account.

- Instant Processing: Most deposits, especially those made through electronic methods or credit cards, are processed instantly, allowing traders to quickly capitalize on market opportunities.

- Transparency: Exness promotes transparency, ensuring that traders are fully informed of all costs involved. Additional charges usually come from payment service providers or banks.

- Diversity of Payment Methods: The platform supports several options, including bank transfers, credit/debit cards, and e-wallets such as Neteller, Skrill, and WebMoney, offering overall convenience and flexibility.

Starting Your Business Journey with Exness

Getting started with Exness is a straightforward process:

- Account Registration: Complete the registration form, provide your personal information and go through the necessary verification procedures.

- First Deposit: Make your first deposit following the minimums required to activate your selected account type.

- Start Trading: With your account now funded, you can start exploring the markets using the robust trading platforms offered by Exness.

Understanding minimum deposits and related conditions is essential to effectively plan your financial strategy and commitment at Exness. With its competitive and transparent policies, Exness creates a supportive environment that welcomes both novice and more experienced traders, making it an attractive option for those who want to succeed in the financial markets.

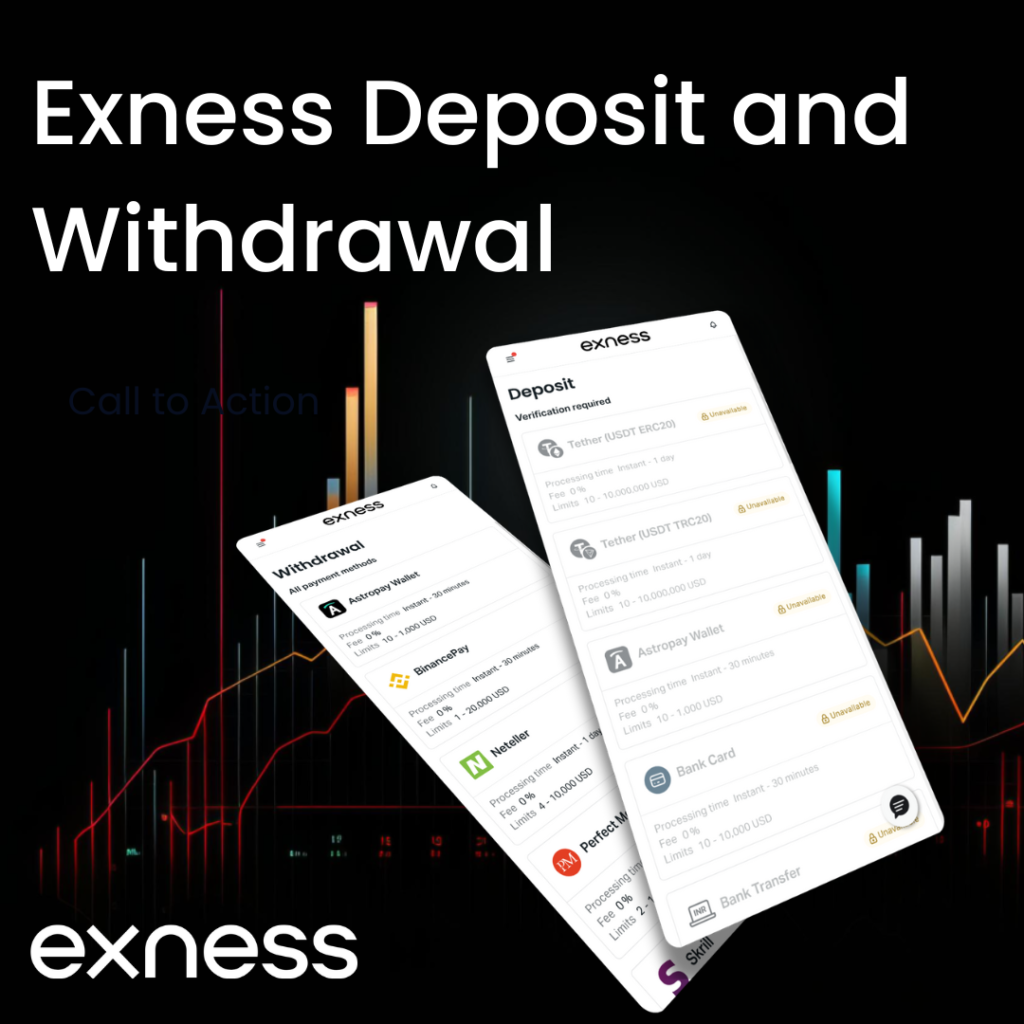

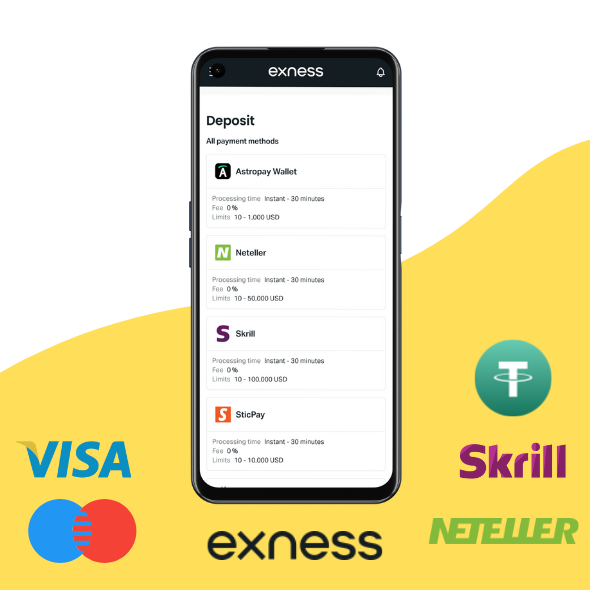

Deposit Methods and Fees at Exness

Exness offers a wide range of deposit methods to meet the needs of its diverse global clientele, ensuring flexibility and accessibility. This guide details the deposit methods available at Exness and the associated fee structure, helping traders manage their funds efficiently.

Deposit Methods at Exness

Exness has expanded its deposit method offering to adapt to both regional preferences and emerging financial technologies:

- Local Bank Transfers: Available in many countries, they facilitate faster access to funds with a reduced need for currency conversion.

- Prepaid cards: They offer an additional layer of privacy and control, ideal for those who prefer not to use their bank accounts directly.

- Mobile Payments: Supports popular mobile payment systems in certain regions, suitable for merchants who primarily transact through their smartphones.

- Region-Specific Payment Systems: Aligned with local preferences, these systems offer convenient and personalized payment solutions.

No deposit limits: To maximize flexibility, Exness imposes no maximum deposit limits, allowing traders to fund their accounts based on their individual strategies and needs. Minimum deposits are low, starting at just $1 for some accounts, encouraging affordable entry for new traders.

Fees Associated with Deposits at Exness

Exness is known for its transparency and affordability, avoiding internal fees on deposits. However, external costs may apply:

- Third Party Fees: Some payment processors or banks may impose their own fees, especially on transactions involving currency conversion.

- Currency Conversion: Deposits in a currency other than the account’s base currency may incur conversion fees.

Tips for Cash Deposits

- Keep your payment information up to date: Regularly check the accuracy of your information to avoid delays in deposits.

- Review payment processor policies: Some methods may include additional fees or have specific processing times.

- Use the right method for your needs: Consider speed, cost and convenience when choosing a deposit method.

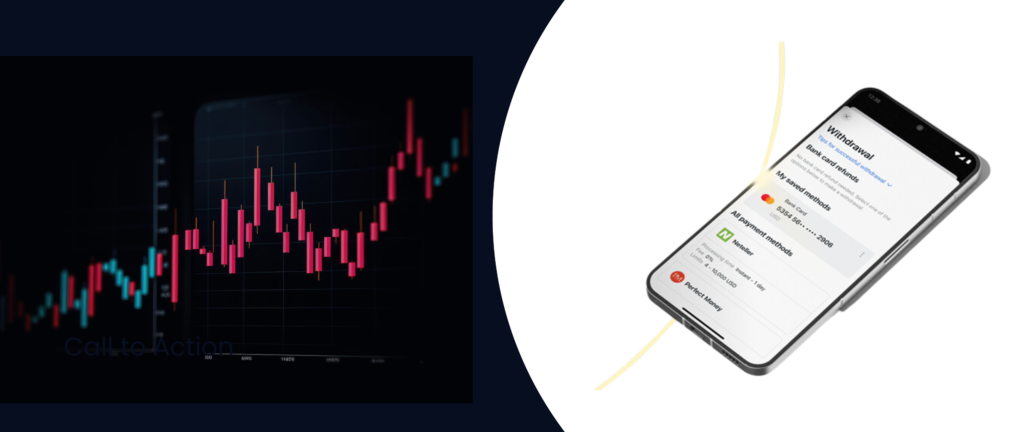

Start with Deposits at Exness

To start depositing into Exness:

- Log in to your Personal Area: Access the ‘Deposit’ section.

- Select Deposit Method: Choose from the available options.

- Complete the Transaction: Follow the instructions to finalize your deposit.

Exness’ various deposit methods are designed to provide security, speed and convenience, ensuring that traders around the world can start their trading activities efficiently. Understanding these options and the associated fee structure is essential for effective financial management in trading.

Currency Options for Exness Accounts

Exness offers a wide range of account currency options to meet the needs of its global clientele. This flexibility allows traders to choose a currency they are most familiar with or one that offers advantages based on their geographic location or trading strategy. Below is a detailed description of the currency options available for an Exness trading account:

- US dollar (USD): Widely used in global trade and considered a global reserve currency.

- Euros (EUR): Used by most countries in the European Union and is the second most common reserve currency.

- British pound sterling (GBP): Currency of the United Kingdom, known for its stability and relevance in the global financial market.

- Australian dollar (AUD): Commonly traded due to the strength of the Australian economy.

- Japanese yen (JPY): Third largest and widely used reserve currency in the Asian market.

- Swiss franc (CHF): Considered a “safe haven” currency due to Switzerland’s neutrality and financial stability.

- Canadian dollar (CAD): Currency of one of the most stable economies in the world and rich in natural resources.

- New Zealand dollar (NZD): Also known as “kiwi”, it is important in commodity markets.

- Chinese Yuan (CNY): Currency of one of the largest emerging economies.

- Russian ruble (RUB): National currency of Russia, relevant in the energy market.

- Polish Zloty (PLN): Currency of Poland, a significant economy in Eastern Europe.

- Singapore Dollar (SGD): Used in one of the most important financial centers in Asia.

- Hong Kong dollar (HKD): Currency linked to the US dollar, used in one of the most influential financial markets.

- Bitcoins (BTC): Leading cryptocurrency that offers new investment and trading options.

- Ethereum (ETH): Important cryptocurrency for its blockchain technology and smart contract.

- Litecoin (LTC): Known as the silver of cryptocurrencies to the gold of Bitcoin.

- South African rand (ZAR), Mexican peso (MXN), Turkish Lira (TRY), Swedish krona (SEK), Norwegian Krone (NOK), Danish krone (DKK), Corona Checa (CZK), Hungarian florin (HUF), indian rupee (INR), Thai Baht (THB), Indonesian Rupia (IDR), Ringgit far (MYR), Vietnamese Dong (VND): Currencies from emerging markets and developing economies that are important in regional trade.

This extensive list of currency options highlights Exness’ commitment to accommodating traders from different regions by allowing them to manage their accounts in the currency that best suits their needs. Choosing the right account currency can help traders save on conversion fees and simplify their financial management.

How to Deposit Money into Exness: A Step-by-Step Guide

1. Access to your Account

- Log in: Visit the official Exness website and log in with your credentials to access your Personal Area.

2. Navigation to the Deposit Section

- Deposit Option Location: Once inside your Personal Area, go to the “Deposit” section, usually accessible from the dashboard or finance tab.

3. Deposit Method Selection

- Choose your Preferred Method: Select from available options such as credit/debit cards, bank transfers, e-wallets, and cryptocurrencies.

4. Entering Deposit Details

- Specify Amount and Details: Enter the amount you wish to deposit and fill in any other required details. Please review the possible deposit limits and fees applicable at this time.

5. Confirmation of Currency and Details

- Coin Matching: Make sure the deposit currency matches the base currency of your account to avoid conversion fees. Please check that all details entered are correct.

6. Complete Security Checks

- Additional Verifications: If required, complete any additional security verifications, such as two-factor authentication or confirmations via your email or mobile phone.

7. Completion of the Deposit

- Shipping and Confirmation: Review all information, confirm it is correct, and proceed to submit your deposit. You should receive an on-screen confirmation and possibly an email notification.

8. Verification of your Account Balance

- Confirmation of Funds: Return to your dashboard to verify that the funds have been successfully added to your account balance. Deposits via electronic methods are usually instant, while bank transfers may require more time.

Security of your Funds Deposited in Exness

Exness implements advanced security measures to ensure the protection of your funds and personal information:

- Continuous Monitoring and Risk Management: Advanced systems are used to monitor and prevent fraudulent activities.

- Two-Factor Authentication (2FA): This feature adds an extra layer of security during the login process and other sensitive operations.

- Data Privacy Protection: Exness follows strict regulations to ensure that all customer information is adequately protected.

- Customizable Security Settings: Customers can adjust their own security settings for optimal protection.

- Education and Awareness: Resources are provided to help customers identify and avoid security threats, such as phishing attempts.

- Dedicated Support: A security team is available to assist with any queries or issues related to account security.

By implementing these measures, Exness ensures that it offers a secure environment so that traders can focus on their trading activities without worries.

Frequently Asked Questions about Minimum Deposits at Exness

Does the deposit currency have to match the currency of my Exness account?

The deposit currency does not need to match the currency of your Exness account. Transactions in a different currency will be automatically converted to your account’s base currency using competitive exchange rates. Please take into account possible fluctuations that may affect the final amount received.