- Key Features of Exness Investment Calculator:

- Benefits of using the Exness Investment Calculator:

- How to access the Investment Calculator:

- Setting up the Exness Investment Calculator

- Interpretation of the Results of the Exness Investment Calculator

- Example of Using the Exness Investment Calculator

- Understand the Possible Benefits and Risks

- Customizable Investment Scenarios

- Key Advantages over Traditional Methods

- Integration of the Investment Calculator into your Investment Strategy

- Frequent questions

Key Features of Exness Investment Calculator:

- Earnings Calculator: It allows traders to estimate potential profits or losses based on variables such as entry price, exit price, trade size and currency pair.

- Currency calculator: Crucial for Forex traders, this tool assists in currency conversion and calculation of margin requirements.

- Leverage Calculator: It helps understand the impact of leverage on trading, which can amplify both profits and losses.

- Operations calculator: It combines features from profit, forex and leverage calculators to provide a comprehensive view of the financial aspects of planned trades.

Benefits of using the Exness Investment Calculator:

- Risk management: It facilitates the exact calculation of the risks associated with each operation, helping to keep exposure within manageable limits.

- Strategic planning: Supports the definition of trading parameters such as entry and exit points, expected returns and stop-loss orders.

- Financial Optimization: It allows for efficient use of leverage and balances potential high returns with potential high risks.

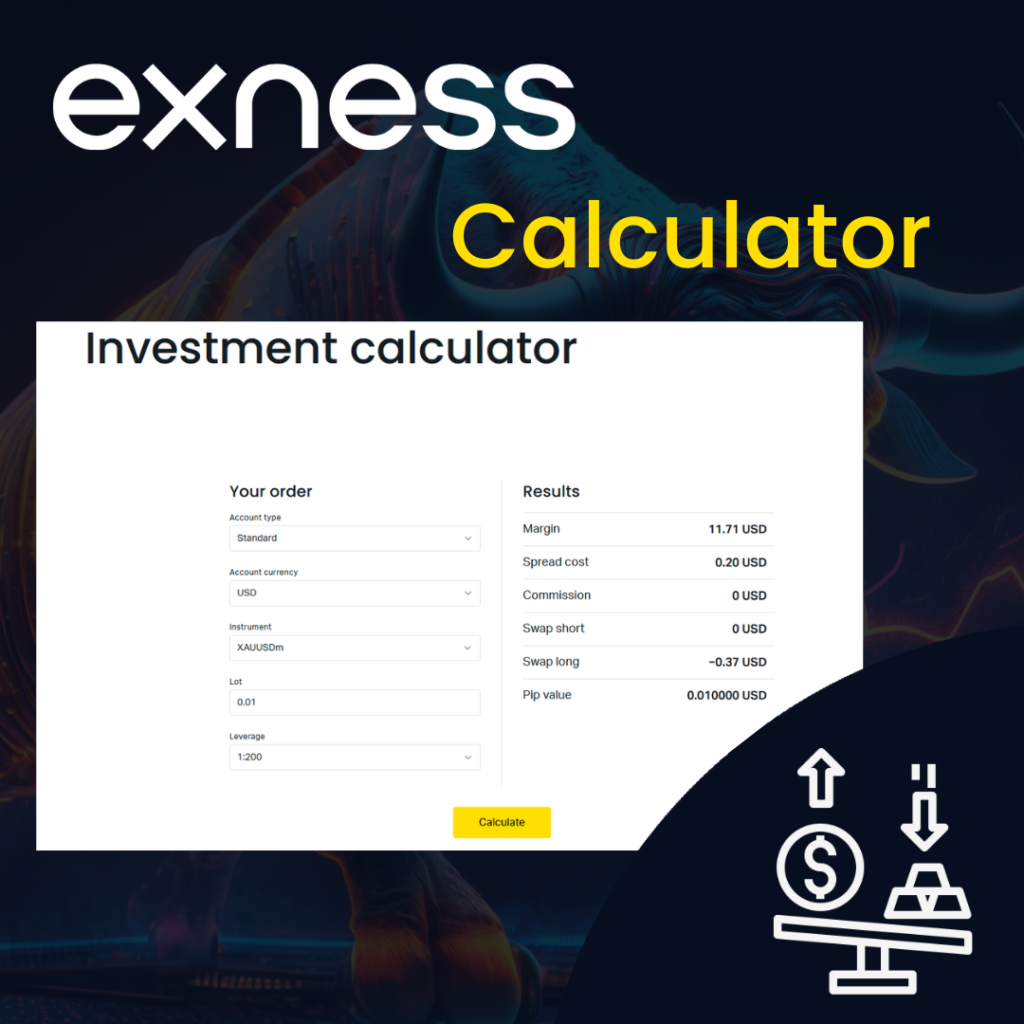

How to access the Investment Calculator:

The Exness Investment Calculator can be easily accessed from the Exness website, within the tools or resources section. Traders simply need to log into their Exness account to use this functionality, ensuring that all calculations are customized according to the specific conditions of their accounts and trading setups.

The Exness Investment Calculator is an invaluable addition for both novice and experienced traders, providing crucial data that helps make more informed trading decisions and effectively manage trading portfolios.

Setting up the Exness Investment Calculator

To ensure optimal use of the Exness Investment Calculator, it is crucial to carefully select the account type and trading instrument, as well as enter accurate details such as position size, entry price and leverage. Below are the key steps and considerations to set up the calculator effectively:

Account Type Selection

- Procedure: Start by selecting the type of trading account you have with Exness, such as Standard, Pro or ECN. This selection is vital as different account types offer different conditions, such as spreads, leverage options and commission rates, which affect the calculation results.

- Impact: Choosing the right account type is essential as it influences the profitability and risk level of your trading based on the specific account conditions.

Commercial Instrument Selection

- Procedure: Choose the trading instrument you plan to trade, such as currency pairs, commodities, indices or cryptocurrencies.

- Impact: Each instrument has unique characteristics, such as volatility and liquidity, which are crucial to accurately calculate potential profits and manage risks effectively.

Enter Position Size, Entry Price and Leverage

Position Size:

- Procedure: Enter your position size, usually measured in lots or units, depending on the instrument. This size directly affects both the potential return and risk of the trade.

- Impact: Larger positions can increase both potential profit and risk. It is vital to balance your position size within your overall risk management strategy.

Entry price:

- Procedure: Enter the entry price at which you anticipate entering the trade, based on your market analysis and trading strategy.

- Impact: The entry price is crucial in determining the initial cost of the trade and essential in calculating potential profits or losses based on your target and stop-loss levels.

Leverage:

- Procedure: Select the amount of leverage you want to apply to your trade. Leverage allows you to increase your exposure without a commensurate increase in your capital investment.

- Impact: While leverage can improve returns, it also increases risk. It is important to use leverage wisely, taking into account both its benefits and potential risks.

Choose Account Currency

Procedure:

- Choose the currency in which your trading account is denominated. This setting is essential to ensure that the calculator results accurately reflect the actual monetary values of the profits and losses in your trading account.

Impact:

- Selecting the correct account currency is crucial to making accurate calculations of profits, losses and required margin, especially considering currency conversion rates if your account currency differs from the currency pair you are trading.

Effective use of the Exness Investment Calculator helps to meticulously plan each trade, considering multiple financial metrics and trading conditions. By accurately entering details such as account type, trading instrument, position size, entry price, leverage and account currency, you get a comprehensive view of potential results. This planning helps maximize potential returns and improves the ability to manage associated risks effectively.

Interpretation of the Results of the Exness Investment Calculator

Using the Exness Investment Calculator effectively is crucial for traders looking to maximize their returns and manage their risks. This tool provides detailed information on various financial aspects of a planned operation. Here’s how to interpret the key results provided by the calculator:

Margin Requirements and Impact of Leverage

Margin Requirements:

- Explanation: It is the amount of capital necessary to open and maintain a position. This varies depending on the leverage and size of the trade.

- Interpretation: Greater leverage reduces the necessary margin, allowing you to operate with larger volumes without requiring more capital. However, it increases the risk, as market fluctuations have a proportionately greater impact on your balance.

Cost of Differential and Commissions

Differential Cost:

- Explanation: Represents the difference between the purchase and sale prices offered for an instrument, reflecting the cost implicit in each operation.

- Interpretation: A lower spread means lower transaction costs, which is especially important in high-volume or frequent trading strategies.

commissions:

- Explanation: Some accounts or instruments may incur fixed commissions per transaction.

- Interpretation: It is essential to consider commissions when calculating profitability, especially for traders who make many transactions.

Swaps and Position Maintenance Costs

Swaps:

- Explanation: Interest charged or paid for maintaining an open position beyond the market close, based on the interest rates of the currencies involved.

- Interpretation: Swap costs can add or subtract from your profits, depending on the direction of your trade and the interest rate differential.

Pip Value for the Selected Instrument

Pip value:

- Explanation: Shows the change in the position value for a one pip movement in the price of the instrument.

- Interpretation: It is essential to manage risk and plan the placement of stop-loss and take-profit orders. The pip value helps to understand the impact of market fluctuations in monetary terms.

Calculator Access

To access the Exness Investment Calculator, simply log into your Personal Area on the Exness website and select the tool from the tools menu. Make sure you are familiar with all functions and settings to take full advantage of the calculator’s capabilities.

Understanding how to interpret and apply the results of the Exness Investment Calculator is crucial to effective business planning. This understanding allows traders to make informed decisions, manage risk appropriately, and optimize strategies to improve trading results. Using this tool can be decisive in the search for success and profitability in the forex market.

Example of Using the Exness Investment Calculator

Let’s look at an example using the Exness Investment Calculator to demonstrate how to calculate potential profits, required margin and understand the pip value for a specific trade.

Scenery:

A trader wants to estimate potential profits and calculate the margin required for a trade on the EUR/USD pair.

- Account type: Standard

- Commercial instrument: EURUSD

- money account: American dollar

- Position size: 1 lot (100,000 units)

- Entry price: 1.1800

- Starting price: 1.1850

- Exploitation: 1:100

Steps to use the calculator:

- Select account type: Choose “Standard” from the drop-down menu. This choice affects spread and leverage options.

- Input negotiation instrument: Select ‘EUR/USD’ from the list. This step is essential as different instruments may have different spreads and margin requirements.

- Set account currency: Confirm that ‘USD’ is selected, ensuring that all financial calculations are displayed in the trader’s account currency.

- Enter position size: Enter ‘1 lot’, which is equivalent to 100,000 units of the base currency. Position size is critical to calculating required margin and potential profits.

- Provide entry and exit prices: Enter ‘1.1800’ for the entry price and ‘1.1850’ for the exit price. This difference will determine the profit or loss of the operation.

- Choose leverage: Select ‘1:100’ from the leverage options. Leverage affects the amount of margin required to open and maintain the position.

Interpretation of results:

- Calculation of profit and loss: The calculator will automatically calculate the profit or loss based on the entry and exit prices. In this scenario, the trade generates a profit from the 50 pip move in the EUR/USD pair.

- Required margin: With leverage set to 1:100, the calculator shows how much capital (margin) is needed to open the trade. Lower leverage means higher margin requirement.

- pip value: The calculator also provides the value of each pip movement. Understanding the pip value is crucial for this trade as it determines the monetary gain from the 50 pip increase.

This example demonstrates the practical use of the Exness Investment Calculator to strategically plan a trade, evaluate potential returns and understand the financial implications of the trade setup. It is an invaluable tool for traders to maximize their efficiency and manage risk more effectively.

Understand the Possible Benefits and Risks

- Profit Calculations: Allows traders to enter hypothetical entry and exit points to project potential profits or losses. This feature is essential for setting realistic profit goals and strategically planning operations.

- Risk assessment: Calculates the required margin based on the selected leverage, providing insights into the capital at risk. This helps traders manage their capital more efficiently and make informed decisions based on their risk tolerance.

Customizable Investment Scenarios

- Versatility in Parameters: Traders can adjust various factors, such as position size, leverage, and stop-loss and take-profit levels, to see how these changes affect potential results.

- Scenario Analysis: Facilitates the simulation of different market conditions and the testing of hypothetical scenarios without financial risk. This is crucial for optimizing strategies and experimenting with trade setups.

Key Advantages over Traditional Methods

- Speed and Efficiency: Provides instant calculations that are much faster and more efficient than manual methods such as using spreadsheets.

- Accuracy: Automatically adjusts settings to reflect current market conditions and provides accurate instrument specifications, reducing the likelihood of errors.

- Accessibility: Available directly through the web, the calculator can be accessed from anywhere, offering convenience and flexibility without the need for downloads.

- Comprehensive Analysis: Integrates multiple financial calculations into one tool, offering a holistic view of potential business outcomes.

Integration of the Investment Calculator into your Investment Strategy

Incorporating the Exness Investment Calculator into your trading strategy can significantly improve your decision making and risk management. Here’s how to use it effectively:

- Pre-Negotiation Analysis: Use the calculator to evaluate potential profits and risks before executing trades, setting precise entry and exit points.

- Risk management: Constantly adjust leverage and margin to ensure you are not overexposed on any trade.

- Performance Review: After trades, compare expected results with actual results to evaluate the accuracy of your strategies.

- Strategic Adjustments: Based on the calculator results, make necessary adjustments to your trading strategies.

- Educational Tool: For novice traders, the calculator also acts as an educational resource to understand market dynamics and the financial effects of different trading strategies.

Conclusion: The Exness Investment Calculator is an advanced tool that offers clear advantages over traditional methods, including greater speed, efficiency, accuracy and accessibility. By integrating this tool into your trading approach, you not only facilitate operational efficiency but also encourage more effective strategic growth in trading.

Frequent questions

What is the best leverage for a $10 account at Exness?

- Answer: For a $10 account, it is advisable to use a low leverage, such as 1:100 or 1:200. Although Exness offers leverage up to 1:2000, more conservative levels help manage risk more effectively, especially for beginners.