- Deposits at Exness

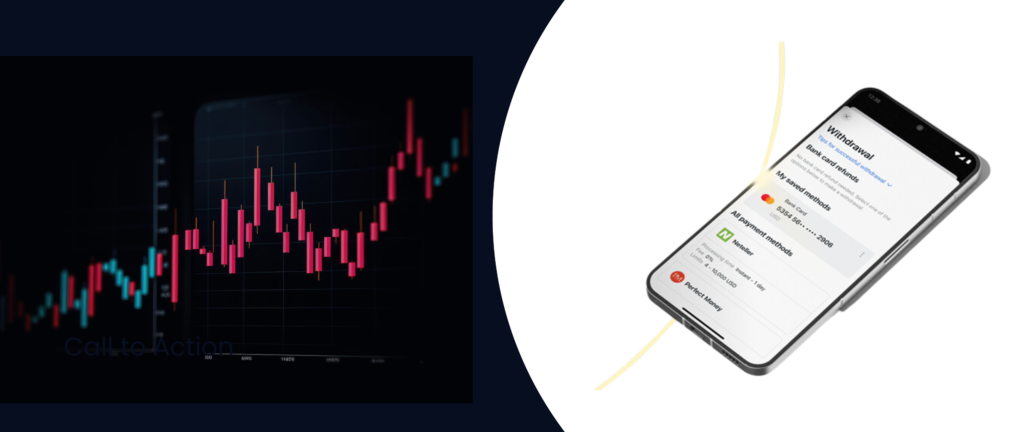

- Exness Retreats

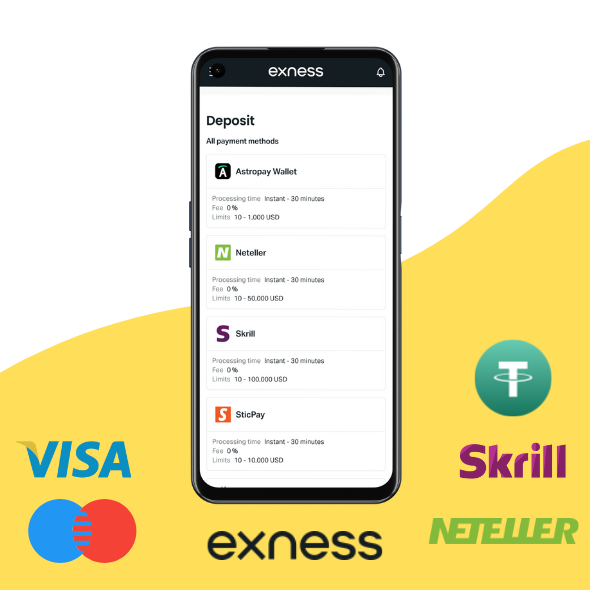

- Payment Methods in Exness

- Base Currencies in Exness

- Making Deposits in Exness: Complete Guide for Traders

- Withdraw Funds from Exness: Efficient and Flexible Options

- Exness Withdrawals: Understanding Limits, Fees and Common Problems

- Security Measures in Exness Transactions: Comprehensive Protection for Secure Operations

- Tips to Ensure Smooth and Secure Transactions at Exness

- Frequently Asked Questions about Payments at Exness

Deposits at Exness

- Ease and Speed: Exness offers instant deposit options for most payment methods, making it easy for traders to start trading without delays.

- Security: Transactions are protected with advanced encryption protocols, ensuring the security of financial information and the integrity of users’ funds.

Exness Retreats

- Fast Processing: Withdrawals at Exness are known for their speed, with many being processed instantly or within 24 hours, depending on the method chosen.

- Minimum Charges: Exness strives to minimize withdrawal fees. Although the platform itself does not usually charge fees, payment service providers may apply charges in certain cases.

- Boundaries: There are generally no maximum withdrawal limits at Exness, although they may be subject to payment method restrictions or available account balance.

- Wait time: Withdrawal processing time may vary. While many are instant, others can take anywhere from a few hours to several business days.

Payment Methods in Exness

- Bank transfers: Recommended for large transactions, although processing time may vary by bank.

- Credit/Debit Cards: Accepts major cards such as Visa and MasterCard, allowing instant deposits and fast withdrawals.

- Electronic Wallets: Includes options like Neteller, Skrill and WebMoney, which offer efficiency and speed.

- Cryptocurrencies: Bitcoin and other major cryptocurrencies are accepted, providing a modern, secure and affordable transaction option.

Base Currencies in Exness

To facilitate global trading, Exness allows traders to choose from various base currencies, minimizing the need for conversions and associated costs:

- USD (American dollar)

- EUR (Euro)

- GBP (Pound sterling)

- JPY (Japanese yen)

- AUD (Australian Dollar)

- CAD (Canadian dollar)

- CHF (Swiss franc)

- NZD (New Zealand Dollar)

This variety helps traders manage their accounts in the currency that is most economical and practical for them, reducing exposure to adverse currency fluctuations.

Exness simplifies fund management with speed of execution, minimal fees, and strong security measures. For both novice traders and seasoned professionals, Exness provides comprehensive support to ensure efficient and effective management of trading finances.

Making Deposits in Exness: Complete Guide for Traders

Funding your Exness account is a process designed to be quick and efficient, allowing you to manage your business finances without complications. Here we provide you with a detailed guide on how to make deposits, including information on limits, fees, troubleshooting and available bonuses.

Deposit Limits and Fees at Exness

Deposit Limits:

- Minimum Deposit: Varies depending on account type and deposit method. Standard accounts may have no minimum requirement, while more specialized accounts may require a larger initial deposit.

- Maximum Deposit: Generally, there are no maximum limits set by Exness, but there may be restrictions based on the payment method selected.

Associated Rates:

- Deposit Fees: Exness does not charge fees for making deposits, although payment processors may impose their own fees, especially on transactions involving currency conversions.

- Currency Conversion: If you deposit in a currency other than your account’s base currency, a conversion fee may apply. It is crucial to consider this when choosing the base currency for your account.

Common Problems with Deposits and Solutions

Frequent Problems:

- Transaction not processed: Issues such as errors in payment details or lack of funds can prevent a deposit from being made.

- Delayed Transactions: Although many deposits are instant, methods such as bank transfers can take time, affecting your trading activity.

Solutions:

- Check Details: Please confirm that all payment details are correct before making a deposit.

- Consult the Payment Provider: In case of delays, check with your payment provider to determine if the problem is on your end.

- Contact Exness Support: If a deposit does not reflect in your account after the expected time, Exness customer support can help resolve the issue effectively.

Deposit Bonuses at Exness

Bonus Availability:

- Promotional Offers: Exness occasionally offers deposit bonuses as part of promotions, providing additional credit based on the amount deposited.

- Terms and Conditions: Each bonus has specific requirements, including minimum deposit amounts and eligibility criteria that must be fully understood to take advantage of the bonuses.

Benefits of Deposit Bonuses:

- Increase Trading Volume: Bonds can increase your trading power, allowing for larger or more frequent trades.

- Risk management: Additional funds can be used to diversify trading risks, offering more flexibility in how you manage your trades.

Depositing at Exness is designed to be a seamless process, with support for a wide range of payment methods and currencies, suiting traders all over the world. While the system is made to minimize inconveniences, being prepared to resolve common problems can further improve your trading experience. Additionally, deposit bonuses, when available, can offer a significant boost to your trading strategy and capital efficiency.

Withdraw Funds from Exness: Efficient and Flexible Options

Withdrawing funds from your Exness account is designed to be a simple and flexible process, with a variety of methods tailored to meet the needs of traders around the world. This article provides an in-depth analysis on how to withdraw effectively using Skrill, and gives an overview of the general withdrawal times on Exness.

Skrill Retreats in Exness

How to Withdraw Money Using Skrill:

- Log in to your personal area: Access your Exness account by entering your credentials.

- Select ‘Withdraw’: Head to the withdrawal section and choose Skrill from the list of available options.

- Enter withdrawal details: Specify the amount you want to withdraw and make sure the email associated with your Skrill account is correct.

- Confirm the transaction: Complete the withdrawal by following the instructions, which may include verifying the transaction via a code sent to your email or phone.

Advantages of Using Skrill:

- Speed: Withdrawals through Skrill are typically processed instantly, allowing funds to be available quickly.

- Low rates: Skrill offers competitive rates, making it an affordable option for traders.

- Easy to use: Skrill is easy to use, making it easy to make quick and hassle-free transactions.

Important considerations:

- Make sure your Exness and Skrill account email addresses match to avoid withdrawal delays.

General Withdrawal Times in Exness

Instant Withdrawals:

- Many withdrawal methods at Exness, including e-wallets like Skrill, offer instant processing.

Bank Transfers and Credit Cards:

- Withdrawals via banks or credit cards can take anywhere from a few hours to several business days, depending on factors such as bank processing times.

Factors Affecting Withdrawal Times:

- Verification status: Verified accounts generally experience faster withdrawal processes.

- Withdrawal amount: Large quantities may require additional security checks, extending processing times.

- Payment service provider: The speed of the payment service provider or bank can also affect the speed of the withdrawal.

Tips for Efficient Withdrawals

- Advance verification: Please ensure you complete all KYC verification procedures before making your first withdrawal to avoid delays.

- Respect withdrawal limits: Adhering to the limits set by Exness and your selected payment method can prevent problems.

- Keep your payment details up to date: Make sure your payment information is always up to date to avoid delays.

Using Skrill for Exness withdrawals combines convenience, speed and security, making it a popular choice among traders. Understanding withdrawal times and the factors that affect them can help traders manage their financial transactions more effectively, ensuring access to their funds when they need it. This comprehensive approach improves the trading experience, allowing traders to focus more on their strategies and less on administrative concerns.

Exness Withdrawals: Understanding Limits, Fees and Common Problems

Exness facilitates a transparent and efficient withdrawal process for traders, offering multiple withdrawal methods and a clear policy. Below are the withdrawal limits, associated fees, and solutions to common problems that may arise during the process.

Withdrawal Limits

Minimum and Maximum Limits:

- Minimum Limits: They vary depending on the payment method; For example, e-wallets like Skrill generally have lower minimum withdrawal limits.

- Maximum Limits: These may depend on the type of account and available balance, with possible additional restrictions imposed by payment processors.

Daily and Monthly Limits:

- These limits are set by payment processors and may vary. It is essential to review these details with the selected payment method and confirm with Exness for complete understanding.

Rates

Withdrawal Rates:

- Exness: It does not impose fees for withdrawals, although indirect costs from third parties may apply.

- Payment Providers: Banks and e-wallets may have their own fees, which need to be verified directly with them.

Currency Conversion Fees:

- They apply if the withdrawal is made in a currency other than the base currency of the account, with rates depending on the service provider’s policies and current exchange rates.

Common Withdrawal Problems

Delayed Withdrawals:

- Although Exness processes withdrawals quickly, certain methods such as bank transfers may experience delays.

Withdrawal Denials:

- Errors in payment details or failure to comply with anti-money laundering regulations can lead to rejections. Make sure the deposit and withdrawal details match.

Account Verification:

- Unverified accounts or those requiring additional verification for large withdrawals may face delays.

Solutions and Tips for Effective Withdrawals

Complete Account Verification:

- Please ensure all necessary documents and verifications are complete and up to date to avoid delays in withdrawals.

Review Payment Details:

- Confirm the accuracy of all financial details and maintain consistency between deposit and withdrawal methods.

Contact Exness Support:

- In case of problems or questions, Exness customer support can offer detailed assistance and guidance.

Advance Planning:

- Be aware of processing times and plan accordingly, especially during holidays or after-hours when manual processes may be down.

By understanding these aspects and preparing appropriately, you can ensure that your Exness retreat experiences are as smooth and efficient as possible. This careful preparation ensures that you can access your funds in a timely manner and with minimal inconvenience.

Security Measures in Exness Transactions: Comprehensive Protection for Secure Operations

Exness prioritizes transaction security, implementing robust measures to protect customer funds and personal information. This comprehensive overview outlines the key security practices and precautions implemented at Exness to ensure safe trading experiences.

Advanced Encryption Technology

Data Protection: Exness uses SSL (Secure Socket Layer) encryption to safeguard all data transmissions between clients and servers. This advanced technology ensures that personal information and transaction details are securely encrypted, preventing unauthorized access.

Two-Factor Authentication (2FA)

Account Security: Two-factor authentication improves security by requiring not only a password and username, but also a second factor, usually a code sent via SMS or a notification via a recognized device. This additional layer helps protect against unauthorized access to the account.

Compliance with Financial Regulations

Regulatory Standards: Exness adheres to international financial regulations, which require strict measures to combat money laundering, fraud and other illicit activities. This compliance ensures that all transactions are monitored and kept within legal and ethical limits.

Periodic Security Audits

System Checks: Exness conducts regular audits, both internal and external, to identify and rectify any potential vulnerabilities within the transaction system. These proactive audits help prevent security breaches.

Secure Payment Gateways

Secure Transactions: Exness partners with reputable payment providers to ensure that all financial transactions, such as deposits and withdrawals, are processed through secure and trusted gateways.

Tips to Ensure Smooth and Secure Transactions at Exness

- Keep your software up to date: Regularly update your trading platform and related software, including your web browser and antivirus program, to protect against vulnerabilities.

- Use secure networks: Avoid using public Wi-Fi to operate; Instead, use a secure, private, and encrypted Internet connection to ensure the security of your account.

- Periodically monitor account activity: Keep an eye on your trading account activities and check statements for unauthorized transactions. Immediately report any suspicious activity to Exness customer service.

- Implement strong passwords: Use complex and unique passwords for your Exness account and update them regularly. Consider using a password manager to maintain password security and strength.

- Beware of phishing attempts: Be wary of emails or messages that ask for account details or personal information. Always verify the authenticity of such communications by contacting Exness directly through official channels.

Frequently Asked Questions about Payments at Exness

What payment methods are available at Exness?

Exness offers a variety of payment methods, including bank transfers, credit and debit cards (Visa, MasterCard), e-wallets (Skrill, Neteller, WebMoney), and cryptocurrency options. The availability of these methods may vary depending on the user’s country.